How DWP and HMRC Benefit Payments Will Increase in 2024

Benefit payments are going up in 2024. Here is a list of the DWP payment increases for this year

In 2024, people in Lincolnshire who claim benefits, payments, and pensions from the Department for Work and Pensions (DWP) and Her Majesty’s Revenue and Customs (HMRC) can expect an increase in the amounts they receive.

This is great news for people in Lincolnshire including in Scunthorpe, Grimsby, Skegness, Lincoln, and Boston who have been struggling due to the cost of living.

These payment boosts, set to take effect from April onwards, aim to alleviate financial burdens and provide much-needed support to claimants.

While some benefits are adjusted based on inflation rates, others are subject to government discretion.

In this comprehensive guide, we will explore the forthcoming changes in benefit payments for 2024 and provide an overview of the new rates for various benefits.

Understanding Benefit Increases

Benefit increases are essential to ensure that claimants can meet their everyday expenses and maintain a decent standard of living.

Some benefits, including Personal Independence Payment (PIP), Disability Living Allowance (DLA), Attendance Allowance, Carer’s Allowance, and more, are required to increase by at least the level of inflation.

The government determines the increase in pension amounts each year through the “triple lock” mechanism, which considers factors such as inflation and average pay. On the other hand, benefits like Universal Credit are subject to the government’s discretion when it comes to adjustments.

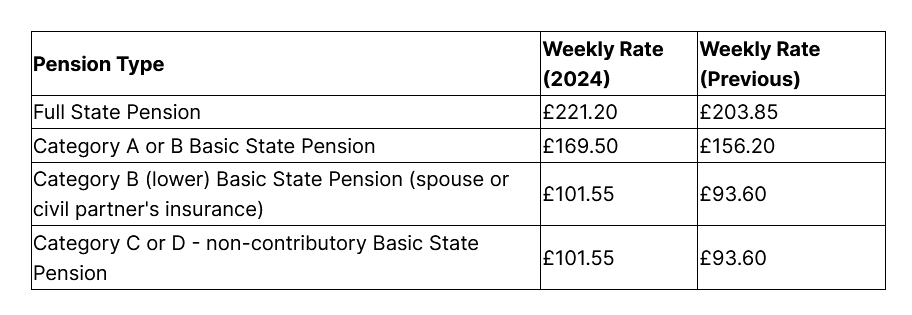

Pension Increases for 2024-2025

Pensioners are set to receive the most significant boosts in benefit payments this year. Here are the new rates for pension payments in 2024-2025:

DWP Benefit Increases for 2024-2025

Beyond pension increases, several other benefits administered by the DWP will also see adjustments in 2024. Here are the new rates for selected benefits:

Attendance Allowance

The Attendance Allowance benefit, designed to assist individuals with care needs, will see the following rate changes:

- Higher rate: £108.55 (previously £101.75)

- Lower rate: £72.65 (previously £68.10)

Carer’s Allowance

Carer’s Allowance, provided to individuals who care for someone with substantial care needs, will be adjusted as follows:

- April 2024 rate: £81.90 (previously £76.75)

- Earnings threshold: £151.00 (previously £139.00)

Disability Living Allowance (DLA) / Scottish Child Disability Payment

DLA, which supports individuals with disabilities and long-term health conditions, will experience changes in its care and mobility components:

- Care component highest rate: £108.55 (previously £101.75)

- Care component middle rate: £72.65 (previously £68.10)

- Care component lowest rate: £28.70 (previously £26.90)

- Mobility component higher rate: £75.75 (previously £71.00)

- Mobility component lower rate: £28.70 (previously £26.90)

Employment and Support Allowance (ESA)

ESA, a benefit for individuals who are unable to work due to illness or disability, will undergo adjustments for different circumstances:

Single Claimants:

- Under 25: £71.70 (previously £67.20)

- 25 or over: £90.50 (previously £84.80)

Lone Parent Claimants:

- Under 18: £71.70 (previously £67.20)

- Over 18: £90.50 (previously £80.50)

Couple Claimants:

- Both under 18: £71.70 (previously £67.20)

- Both under 18 with a child: £108.30 (previously £101.50)

- Both under 18 (main phase): £90.50 (previously £84.80)

- Both under 18 with a child (main phase): £142.30 (previously £133.30)

- Both over 18: £142.25 (previously £133.30)

Incapacity Benefit

Incapacity Benefit, provided to individuals unable to work due to long-term illness or disability, will experience the following adjustments:

- Long-term Incapacity Benefit: £138.90 (previously £130.20)

- Short-term Incapacity Benefit (under State Pension age) lower rate: £104.85 (previously £98.25)

- Short-term Incapacity Benefit (under State Pension age) higher rate: £124 (previously £116.20)

- Short-term Incapacity Benefit (over State Pension age) lower rate: £133.25 (previously £124.90)

- Short-term Incapacity Benefit (over State Pension age) higher rate: £138.90 (previously £130.20)

Income Support

Income Support, a means-tested benefit for individuals with a low income, will see the following adjustments:

Single Claimants:

- Under 25: £71.70 (previously £67.20)

- 25 or over: £90.50 (previously £84.80)

Lone Parent Claimants:

- Under 18: £71.70 (previously £67.20)

- 18 or over: £90.50 (previously £84.80)

Couple Claimants:

- Both under 18: £71.70 (previously £67.20)

- Both under 18 (higher rate): £108.30 (previously £101.50)

- One under 18, one under 25: £71.70 (previously £67.20)

- One under 18, one 25 and over: £90.50 (previously £84.80)

- Both 18 or over: £142.25 (previously £133.30)

Jobseeker’s Allowance (JSA)

JSA, provided to individuals actively seeking employment, will experience adjustments based on contribution-based and income-based criteria:

Contribution-based JSA:

- Under 25: £71.70 (previously £67.20)

- 25 or over: £90.50 (previously £84.80)

Income-based JSA:

- Under 25: £71.70 (previously £67.20)

- 25 or over: £90.50 (previously £84.80)

Maternity Allowance

Maternity Allowance, a benefit for expectant and new mothers, will see adjustments to its standard rate:

- Standard rate: £184.03 (previously £172.48)

Read:PIP Claimants Could Be Due Thousands

Statutory Adoption Pay / Maternity Pay / Paternity Pay / Parental Bereavement Pay

Various statutory payments provided to individuals in relation to adoption, maternity, paternity, and parental bereavement will experience no changes in their earnings thresholds or standard rates.

Statutory Sick Pay

Statutory Sick Pay, a benefit for individuals unable to work due to illness or injury, will undergo no changes in its earnings threshold. However, the standard rate will be adjusted as follows:

- Standard rate: £116.75 (previously £109.40)

Universal Credit

Universal Credit, a comprehensive benefit replacing several previous ones, will see adjustments in its monthly rates:

Single Claimants:

- Under 25: £311.68 (previously £292.11)

- 25 or over: £393.45 (previously £368.74)

Couple Claimants:

- Joint claimants both under 25: £489.23 (previously £458.51)

- Joint claimants, one or both 25 or over: £617.60 (previously £578.82)

Child Benefit

Child Benefit, a benefit provided to families with children, will undergo adjustments based on the number of children:

- Eldest or only child: £25.60 (previously £24)

- Additional children: £16.95 (previously £15.90)

Guardian’s Allowance

Guardian’s Allowance, a benefit for individuals who care for a child whose parents have died, will experience the following adjustment:

- Weekly rate: £21.75 (previously £20.40)

Working Tax Credit

Working Tax Credit, a benefit for individuals in low-income working households, will see adjustments in its maximum per year rates:

- Basic element: £2,435 (previously £2,280)

- Couple and lone parent element: £2,500 (previously £2,340)

- Disabled worker element: £3,935 (previously £3,685)

- Severe disability element: £1,705 (previously £1,595)