Is the UK real estate market still a profitable venture?

UK property is the most mainstream market in the world offering a reasonable chance to gain long-term returns. There are various ways through which one can invest in real estate e.g. via the stock market, purchasing shares in companies which own properties, generating income in the form of rent.

The values of the stocks are sub-ject to daily swings, while the companies have relatively stable value as they are asset backed – i.e. they possess real estate which investors can see and touch in which the company can sell if re-quired to do so. At times of mar-ket turbulence such investors are less likely to take flight.

There is no doubt that the value of land has increased with the passage of time in the UK. The demands have surpassed the supply with the growing population and limited space of the islands. There is high level of uncertainty in the air regarding the UK’s eco-nomic future considering the episode of Brexit. In the midst of all HULT private capital having been providing profitable property investments with – i.e. secured capital re-turns, up-to 3 to 8% per annum, fixed guarantee return, potential fund bonus of 4%, generating higher returns than your average investment account.

The outbreak of Covid-19 affected every sector of the UK. With the implementation of multiple lockdowns around the country the economy faced hard blows. However, the

outlook for UK property has been positive, if not more so. There are various forecasts that predicted the rise of the UK property market to unprecedented levels. The majority of UK PLCs foresee long-term optimism in property market. With the release of the pent-up demand the country experience its record breaking 30% increase in demand for rental property in April, 2021. The residential prices has been on there all time high of 138% higher than 2020.

The disparity between supply and demand in the UK property market is the huge op-portunity for the investors looking for capital investment. Many areas in UK are afford-able at the moment though it is estimated that with the incredible demand and low supply the prices will raise above-average. Residential capital investor analysts esti-mated that the UK renters will gain profit worth over £1 trillion as UK renters will out-number landholders by 2039. This embodies nearly 125 million households in a private rented sector which is all set to grow by 24% by 2021. It is the true manifestation of the power of property investment holds in the UK.

But what ramifications this has on prices?

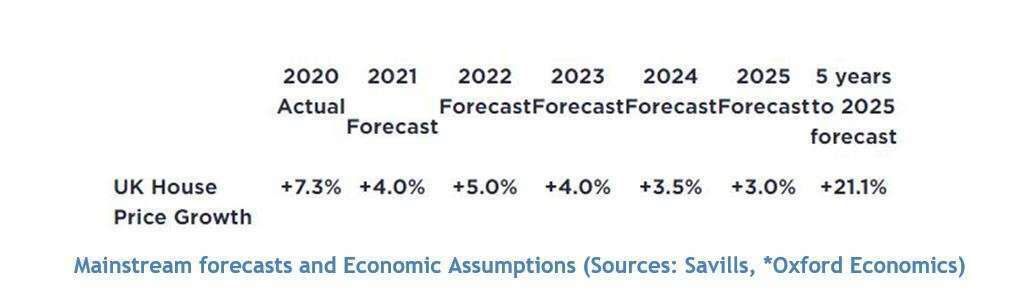

The property forecasts in the UK suggested that the property prices will grow by 21.1% by 2025. The forecast suggested that the property investing market remains a reliable channel for maximising returns amidst low interest rates and high demand. Things have begun to get normal after the turbulence of 2020 and UK investment remains a successful opportunity as we look towards 2022. The regional price growth is all set to continue outpacing the traditional London market, whereas the individual cities within these regions are estimated to over-perform.

It is estimated that UK house prices will rise from zero to +4% growths and with-in the next five years it will raise up-to 21.1%. The housing transactions are expected to hit 1.4m in 2021 before getting back to 1.2m by 2023. As per oxford economics the interest rates are assumed to stay low and base rates are estimated to hit just 0.5% by 2025.

Where & How can you invest?

HULT private capital are the gateway for high net worth sophisticated investors to in-vest in highly desirable locations in and in close proximity to, Prime Central London. It is no secret that Prime central London offers a real investing opportunity. The activity has already picked up its pace as the investors believed in the future of London as a global city. According to residential research analysts’ Prime central London rated a ‘buy’ at -21% from peak and is estimated to rebound strongly, +3% in 2021. It will be followed by the strong bounce up-to +7% in 2022 and total +21.6% in 2021-2025. Whereas the outer prime London residential capital value is estimated to grow +14.6% over the course of next 5 years.

Search for space and lifestyle relocation are the primary impetus behind the growth of UK markets. With the further strong demand in prime lifestyle and country house mar-

kets averaging 20.5% as a 5-year average. It is first time in the history that the house prices have raised in a recession that to up-to 7% as their will to move surpass any un-certainty surrounding jobs and finances.

HULT Private Capital focuses on the best investments for its growing number of high net worth elite investors. Investment funds are secured against the properties which provides stability and full capital security for clients invested capital. HULT has suc-cessfully built up an industry recognised name as an agile investment company one can rely on.

With the increasing population and the disparity between demand & supply, property investment is rising as a prominent kind of investment. With the rise of property devel-opment in 2021, HULT Private Capital provides investors a successful opportunity to achieve access to a high end sector, which incredibly, is still scarce of reliable property development and acquisition specialists.

References:

https://www.savills.co.uk/insight-and-opinion/savills-news/311749-0/savills-upgrades-uk-house-price-forecasts

https://www.moneymarketing.co.uk/analysis/property-funds-one-year-on/